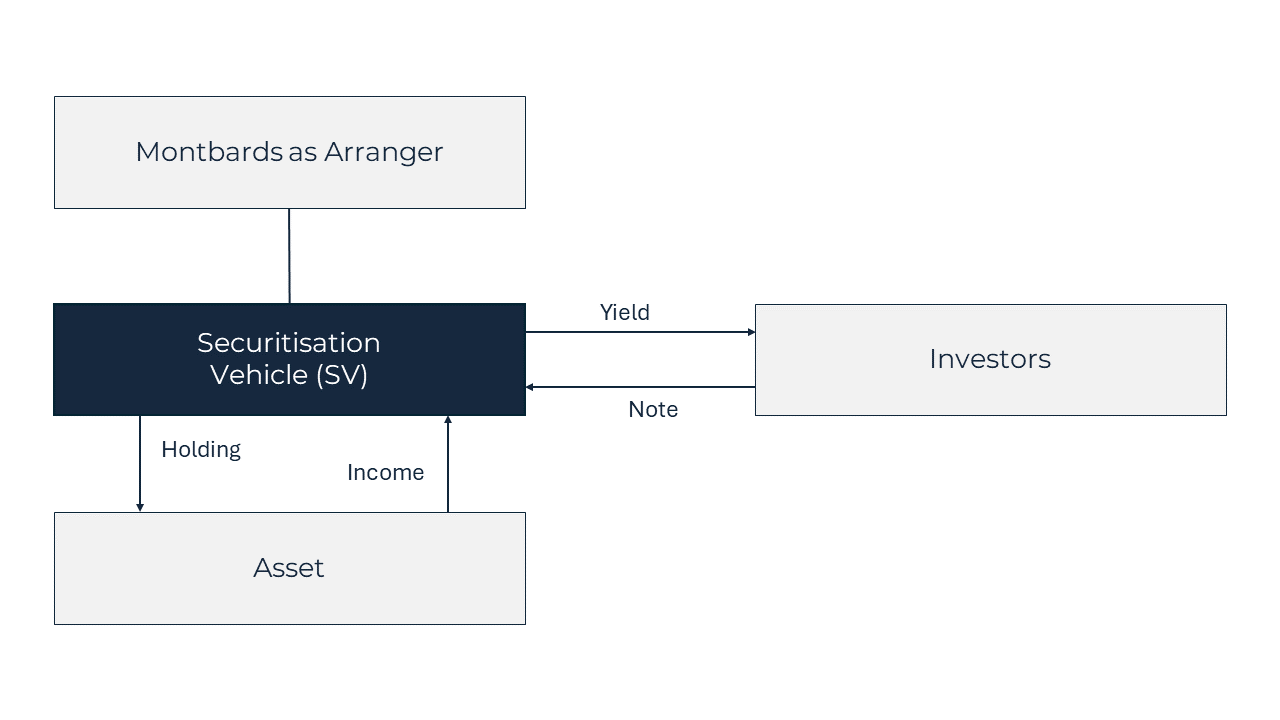

Securitisation transforms a private or illiquid asset into a regulated investment-grade structure. This process enables owners of significant holdings, whether a luxury asset, operating business or estate, to access capital discreetly, without divestment or loss of control.

At Montbards, we design and execute bespoke securitised vehicles backed by alternative assets, suitable for private and institutional investment.